A growing trend in the IPO arena is the use of a special purpose acquisition company (SPAC), which is a shell company that raises capital in an IPO and then acquires an operating company to form a new “merged entity.” A key issue for valuation experts is determining the fair value of equity consideration issued in the SPAC merger transaction. A recent SPAC merger triggered a strong disagreement between a national valuation frm and the merged entity over this very issue. (Note: This article does not disclose the identities of the parties involved (other than myself), and the fnancial data have been changed.)

Background. The fair value of equity consideration issued in a merger in which a public company is the acquirer is generally calculated as the product of the quoted price for the individual equity instrument times the quantity issued (commonly referred to as “P times Q”). However, if the acquirer is a SPAC, determining “P” can be complex and could result in different interpretations of U.S. GAAP between the parties involved in the deal.

A SPAC raises capital in an IPO, typically at a $10.00 per share, and then acquires a target operating company within a specified period of time, normally 18 to 24 months from the date of the SPAC’s IPO. In a SPAC merger, the SPAC acquires and merges with the target company, upon which the SPAC is dissolved and the surviving merged entity becomes the new public entity whose shares trade in the market on a go-forward basis, similar to the completion of an IPO. Sellers of the target company receive as purchase price consideration cash, rollover equity in the merged entity, or a combination of both, and the SPAC public stockholders receive rollover equity. SPAC mergers have become more common in the past few years (e.g. SPAC Diamond Eagle Acquisition Corp.’s merger with DraftKings, a popular sports betting online platform, in April 2020) as private companies seek to go public without the lengthy and costly regulatory process of a traditional IPO.

Illustrative example. In a recent SPAC merger transaction in which I was involved with, the merged entity issued the following types of equity consideration as components of the purchase price to the sellers:

Security Type

Merged entity common share

Merged entity deferred share

Restriction

180-day lock-up period

Vesting subject to occurrence of contingent event

The valuation question is: What is the fair value of the equity consideration issued in this SPAC merger transaction?

Acquirer’s determination of fair value. The acquirer engaged a national valuation frm, with previous experience in SPAC merger transactions, to calculate the fair value of the common and deferred shares the merged entity issued on the merger date. Summarized below are the valuation specialist’s calculations of fair value per share:

Common Share

Common share implied value – $10.00

Discount for lack of marketability – 10%

Fair value per common share – $9.00

Deferred Share

Common share implied value – $10.00

Discount for lack of marketability – 30%

Fair value per deferred share – $7.00

In the valuation specialist’s calculations above, the common share implied value represents the price per common share, as a component of the negotiated transaction price between the SPAC and sellers of the target company in accordance with the terms of the executed merger agreement. Based on the valuation specialist’s interpretation of ASC 805, Business Combinations, the implied value was indicative of the price of the merged entity’s common shares prior to and upon the consummation of the merger.

The discount for lack of marketability applied refects the restrictions on transferability associated with the lock-up period and contingent event vesting conditions, respectively. In their opinion, the valuation specialist believed a market participant would take these restrictions into consideration in pricing the merged entity’s common and deferred shares subsequent to the merger date, applying ASC 820 interpretive guidance that states:

A restriction that would transfer with the asset in an assumed sale would generally be deemed a characteristic of the asset and therefore would likely be considered by market participants in pricing the asset, and “a fair value measurement is for a particular asset or liability. Therefore, in measuring fair value, a reporting entity shall take into account the characteristics of the asset or liability if market participants would take those characteristics into account when pricing the asset or liability at the measurement date. Such characteristics include, for example, restrictions, if any, on the sale or use of the asset.”

[A] quoted price in an active market provides the most reliable evidence of fair value and shall be used without adjustment to measure fair value whenever possible. The merged entity also relied on interpretive guidance of ASC 805, which stated, “if the acquirer issues equity instruments to the acquiree in the business combination, then the acquirer measures the fair value of the equity instruments on the acquisition date and includes that amount as part of the consideration transferred.”

Certain post-vesting restrictions, such as a contractual prohibition on selling shares for a specifed period of time after vesting, are essentially the same restrictions that may be present in equity instruments exchanged in the marketplace.

Finally, the merged entity referred to interpretive SEC guidance its independent auditors provided on the topic of discounts for lack of transferability applied to a security, in which stated that “absent cash transactions in the same or similar instruments, an appraisal of the fair value of the shares by an independent expert generally provides the best evidence of fair value. However, the SEC staff typically examines carefully the determination of the fair value of equity securities. In particular, the SEC staff has aggressively challenged signifcant discounts from the market price of freely transferable equity securities when valuing equity securities with restrictions. In the absence of objective and verifable evidence that supports the fair value of the restricted securities, the SEC staff generally presumes that the best available evidence of fair value is the quoted market price of traded securities with similar, but not identical characteristics (generally, the similar traded, unrestricted security).”

Agree to disagree. The valuation frm maintained its position as to its conclusion of value and did not change its valuation report. The merged entity’s management was ultimately required to provide assertions in the fnal report as to the use of $12.00 per share for the fair value of the merged entity’s common and deferred shares issued as equity consideration on the merger date.

As this case illustrates, the determination of fair value of equity consideration issued as components of the purchase price in a SPAC merger transaction could be subject to disagreements in the interpretation of U.S. GAAP business combination and fair value guidance between the parties to the deal, which must be resolved prior to the issuance of the merged entity’s fnancial statements.

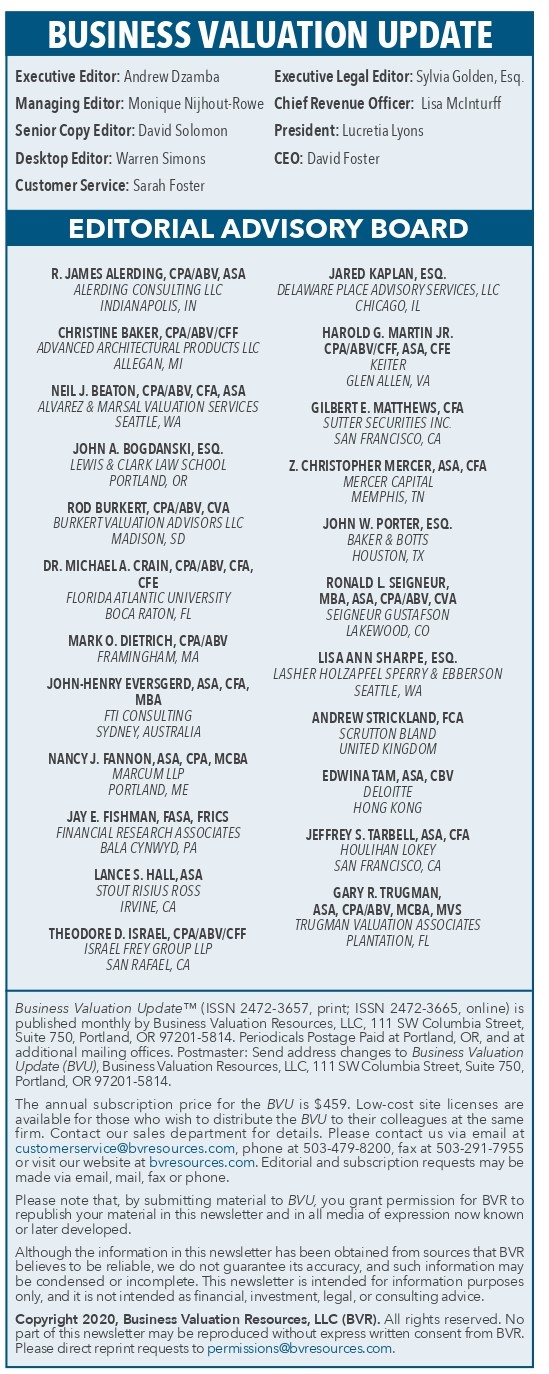

Source: August 2020 issue of Business Valuation Update, published by Business Valuation Resources